The index will rise if the Dollar strengthens against these currencies and fall if it weakens. Keep reading to learn more on the US Dollar Index, how it is calculated, and what affects it price. The index is affected by macroeconomic factors, including inflation/deflation in the dollar and foreign currencies included in the comparable basket, as well as recessions and economic growth in those countries.

Stock indices track the stock market, while DXY shows the USD rate relative to other currencies and its current calculated value. Dollar Index trading is a great way for investors to gain exposure to the US dollar and take a position on the US economy and/or the global market. You agree that LearnFX is not responsible for any losses or damages you may incur as a result of any action you may take regarding the information contained on this website. The regulated signals offered by this website are provided by a third-party service provider and you understand that any losses you may experience from using these signals are entirely at your own risk and liability. By using this site, you implicitly agree that nothing contained on the site shall be construed as a solicitation to buy or sell any product or service in a jurisdiction where its purchase or sale would be contrary to local laws.

It was a wild week, to say the least, while the three main grain markets reminded us of lessons learned over the years. Silver futures have looked like they will explode higher on rallies, but corrections make them appear to fall into a bearish abyss. Over the past six months, selling silver when it looks the best and buying… The following chart shows the U.S. dollar index value from the elimination of the gold standard in January 1971 to January 2022.

The U.S. dollar strikes back: What’s next after August rally

It’s obvious that 24 countries make up a small portion of the world but many other currencies follow the U.S. The euro is the official currency of 19 of the 27 member states of the European Union. Highlights important summary options statistics to provide a forward looking indication of investors’ sentiment. The Barchart Technical Opinion rating is a 40% Buy with a Average short term outlook on maintaining the current direction. The US Federal Reserve broke its string of 10 consecutive interest rate hikes Wednesday. But it was what was said in the announcement that seemed to have makes attention through the close.

- The DXY measures the strength of the US dollar against six other major currencies, such as the EUR, SEK, CHF, JPY, GBP, and CAD.

- The other five currencies include the Japanese yen, the British pound, the Canadian dollar, the Swedish krona, and the Swiss franc.

- The New Highs/Lows widget provides a snapshot of US stocks that have made or matched a new high or low price for a specific time period.

- The DXY refers to the US Dollar Index, which is the global benchmark for the value of the US dollar measured against a basket of foreign currencies.

For the major indices on the site, this widget shows the percentage of stocks contained in the index that are above their 20-Day, 50-Day, 100-Day, 150-Day, and 200-Day Moving Averages. After a turnaround Tuesday attempt overnight failed, cotton prices rallied 33 to 101 points on the day. High interest rates typically weigh on commodity prices as they increase the cost of carrying raw material inventories and increase production expenses.

The Wisdom Tree Bloomberg U.S. Dollar Bullish Fund (USDU) is an actively-managed ETF that goes long the U.S. dollar against a basket of developed and emerging market currencies. An index value of 120 suggests that the U.S. dollar has appreciated 20% versus the basket of currencies over the time period in question. Simply put, if the USDX goes up, that means the U.S. dollar is gaining strength or value when compared to the other currencies. Any information contained in this site’s articles is based on the authors’ personal opinion.

The dollar on Wednesday garnered support from the stronger-than-expected U.S. Weakness in stocks on Wednesday also boosted the liquidity demand for the dollar. However, such a strong Dollar caused problems for US exporters, who found that their goods were no longer as competitive internationally. As a result, the US government took action to make the currency more competitive with five countries agreeing to manipulate the Dollar in the forex markets as part of the ‘Plaza Accord’.

New Highs/Lows only includes stocks traded on NYSE, NYSE Arca, Nasdaq or OTC-US exchanges with over 5 days of prices, with a last price above $0.25 and below $10,000, and with volume greater than 1000 shares. The US Dollar Index can be traded using futures and options or, where permitted, spread betting and CFD trading can also be used to speculate on whether the USDX will go up or down in price. Read more on how to trade US Dollar Index for technical strategies and tips. The US Dollar Index – known as USDX, DXY, DX and USD Index – is a measure of the value of the United States Dollar (USD) against a weighted basket of currencies used by US trade partners.

What is USDX?

WTI prices climbs to the highest level in 10 months after the Organization of the Petroleum Exporting Countries (OPEC) forecasted a surge in oil demand. Gold trades at around $1,910 in the American afternoon, losing ground for a second consecutive day. Major assets seesawed within familiar levels throughout the first half of the day, as investors held ground ahead of the release of United States (US) inflation figures.

Forex Today: Dollar ends eight-day positive streak – FXStreet

Forex Today: Dollar ends eight-day positive streak.

Posted: Mon, 11 Sep 2023 21:06:00 GMT [source]

Conversely, countries that import heavily favour a stronger currency to reduce the foreign exchange cost of paying for those imports. The DXY refers to the US Dollar Index, which is the global benchmark for the value of the US dollar measured against a basket of foreign currencies. First and foremost, if the DXY raises, it will push the USD base pairs higher, and push USD quote pairs lower. USD base pair – such as USD/CHF, and USD/CAD will move with the DXY, as all these currencies are incorporated into the DXY, with USD being on the front end. Inversely USD quote pairs – such as EUR/USD and XAU/USD – will move in the opposite direction of the DXY, creating more space between the quote pairs and the DXY, as USD is on the tail end of these pairs.

Key Data

This is to be expected since the average includes data from the previous, lower priced days. As long as prices remain above the average there is strength in the market. Supply and demand for currencies is heavily influenced by the monetary policies – particularly the interest rates – set by the central bank in each country.

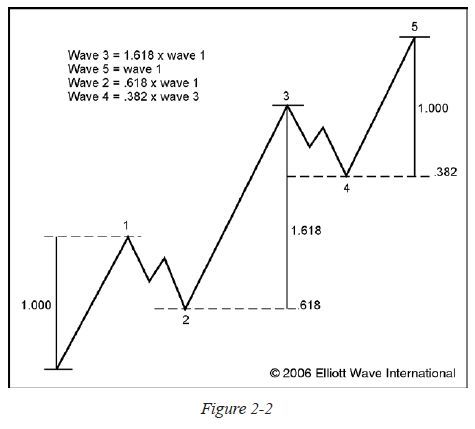

I don’t see Wednesday’s Federal Reserve announcement changing that fact. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Dollar Index. As our members https://1investing.in/ know, ($DXY) has recently given us correction against the… Check out the latest USD Index price with our chart and follow the latest news and analysis from our DailyFX experts.

The prices for the DXY futures contracts are set by the market and reflect differentials in interest rates between the US dollar and the component currencies. The US dollar is the most widely traded currency on the forex market. Over 80% of currency pairs traded feature the USD as either the base or quote currency. The performance of most major currencies are tracked by indices. The US Dollar index (DXY or USDX) is an aggregated indicator of the leading global currency cost relative to a basket of other foreign currencies. Technically, the index can be compared with stock indices, such as Dow Jones or S&P 500.

Forex Today: After US CPI, focus turns to Australian jobs, ECB, and more US data

Over half the index’s value is represented by the dollar’s value measured against the euro. The other five currencies include the Japanese yen, the British pound, the Canadian dollar, the Swedish krona, and the Swiss franc. The US Dollar index chart can be used not only for assessing the current USD trend but also for finding additional trading signals. The prices of the DX futures contracts are set by the market, and reflect interest rate differentials between the respective currencies and the U.S. dollar.

The U.S. Dollar Index (USDX) is a relative measure of the U.S. dollars (USD) strength against a basket of six influential currencies, including the Euro, Pound, Yen, Canadian Dollar, Swedish Korner, and Swiss Franc. The USDX can be used as a proxy for the health of the U.S. economy and traders can use it to speculate on the dollar’s change in value or as a hedge against currency exposure elsewhere. An overvaluation of the USD led to concerns over the exchange rates and their link to the way in which gold was priced. President Richard Nixon decided to temporarily suspend the gold standard, at which point other countries were able to choose any exchange agreement other than the price of gold. In 1973, many foreign governments chose to let their currency rates float, putting an end to the agreement.

We’re also a community of traders that support each other on our daily trading journey. Because the USDX is so heavily influenced by the euro, traders have looked for a more “balanced” dollar index. Today, the company is among the largest exchange groups in the world.

The liquidity on the futures contract for the US Dollar Index comes from the spot currency market, which ICE estimates has a daily turnover of more than $2trn. There is a market maker program that helps to ensure continuous liquidity throughout the day in electronic trading. There is some debate in the currency markets that the US Dollar Index should be reformulated to include currencies from emerging markets that have become larger US trading partners, such as China and Mexico. As a stronger currency can reduce demand for exports to other countries that pay for the goods with relatively weaker currencies, some governments pursue policies to keep down their nation’s currency value.

Currency pairs, on the other hand, generally move in the same direction as the Dollar Index if USD is the base currency, and opposite direction if it is the quote currency – though these ‘rules’ do not always hold true. The USDX uses a fixed weighting scheme based on exchange rates in 1973 that heavily weights the euro. As a result, expect to see big moves in the fund in response to euro movements. Some analysts and economic experts believe that the basket for calculating DXY should be revised and added with other global currencies. It should help to reflect the fact that the USA is currently actively trading with such countries as China, South Korea, Mexico, Brazil, and Australia.

The DXY, or the US dollar index, is an index that tracks the performance of the greenback against other currencies, such as the Japanese yen, Swiss franc, Swedish krona, British pound, Canadian dollar, and an euro. The index was introduced after the Bretton Woods Agreement, which meant the dollar was no longer backed by gold. The DXY originated in March of 1973, shortly after the dismantling of the Bretton Woods system; a unified fixed rate system between the Allied Nations, shortly after the second world war. At this point the DXY hit its all-time high of 164.72, as a result of the first ever DXY futures trading. The DXY would eventually hit it’s all time low of 70.57, in March of 2008. If you’ve traded stocks, you’re probably familiar with all the indices available such as the Dow Jones Industrial Average (DJIA), NASDAQ Composite Index, Russell 2000, S&P 500, Wilshire 5000, and the Nimbus 2001.

The U.S. Dollar Index consists of a geometric weighted average of a basket of foreign currencies against the dollar. The euro is the world’s second leading reserve currency behind the U.S. dollar. The euro is the pan-European currency that changed the foreign exchange market at the turn of this century.

Trends can be upward, downward or sideways and are common to all types of markets. Using CFDs for DXY trading allows you to trade the index in both directions; you can hold a long or short position, depending on whether you expect the price of an asset to rise or fall. CFDs give you the opportunity to profit from price movements in either direction – not only when the value goes up. Prior to the introduction of the types of head and shoulders pattern euro in 1999, the US Dollar Index included the West German mark, the French franc, the Italian lira, the Dutch guilder and the Belgian franc. The only time the components of the index have been changed since 1973 was when these currencies were replaced by the euro. As a global currency benchmark, DXY trading hours run 21 hours a day Sunday – Friday on the ICE platform, with the hours depending on the time zone.

Gold futures settle at a 3-week high as U.S. economic data pressure the dollar and Treasury yields

Even though the DXY will never correlate one hundred percent with dollar-negative or dollar-positive news, the news and the DXY coincide regularly enough to provide palpable data. You can also apply direct Technical Analysis to the DXY, in order to calculate how the DXY is going to move. ICE provides live feeds for Dow Futures that appear on Bloomberg.com and CNN Money. Dollar markets are open, which is from Sunday evening New York City local time (early Monday morning Asia time) for 24 hours a day to late Friday afternoon New York City local time. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools.

Price analysis 8/28: SPX, DXY, BTC, ETH, BNB, XRP, ADA, DOGE … – Cointelegraph

Price analysis 8/28: SPX, DXY, BTC, ETH, BNB, XRP, ADA, DOGE ….

Posted: Mon, 28 Aug 2023 07:00:00 GMT [source]

New delayed trade updates are updated on the page as indicated by a “flash”. Euros and pounds are the only two currencies where the U.S. dollar is the base currency because they’re quoted in terms of the dollar. The others are quoted in terms of how many units a U.S. dollar will buy. The value of each currency is multiplied by its weight, which is a positive number when the U.S. dollar is the base currency.